Are freeholders decisions effecting the value of your leasehold property

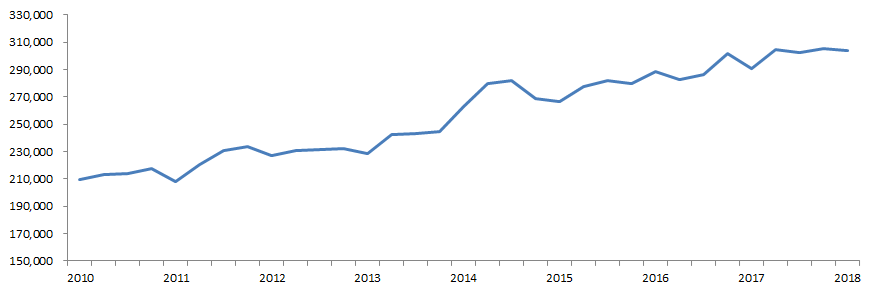

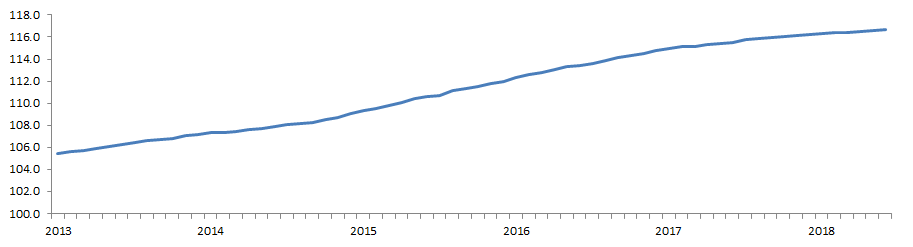

As growth in house and flat prices have leveled off, owners and investors can no longer take automatic and consistent increasing values for granted.

Therefore it has become important to understand how the costs of maintaining your flat will affect the prices - how payments to freeholders and other 3rd parties are reducing the current value of your property.

For example, just a £100 per year increase in your ground rent can knock off £20,000 from the value of your leasehold property.

Understanding this relationship will allow you to better calculate what your flat is actually worth and to take actions to increase the value of your property.

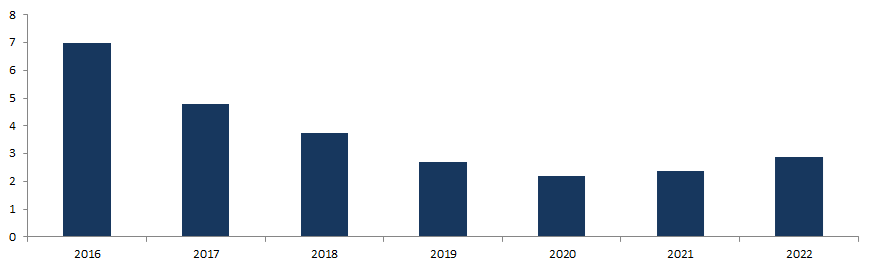

Figure 1: House price increases have begun to flatten since the start of 2017

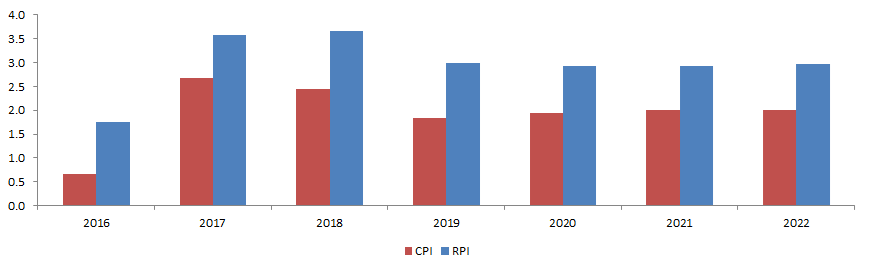

Figure 2: Rent increases have begun to level-off since the beginning of 2018

The effects of interest rates and inflation on your ground rent, service charge and flat values

How long-term increases in costs affect your current property price can be calculated using discounted cash-flow models. These are the equations that investors use to value many different types of assets – by understanding the long-term costs and revenues generated by the asset.

With leasehold flats, the major costs that you incur compared to houses are:

- ground rents,

- service charge and

- lease extension costs.

By understanding these long-term costs, you can understand how much less a flat is worth than the equivalent property without these charges (e.g., a freehold house). Another way of thinking of this is you are answering the question: “how much money would I need to put in the bank to pay for the long-term, annual costs for my flat”.

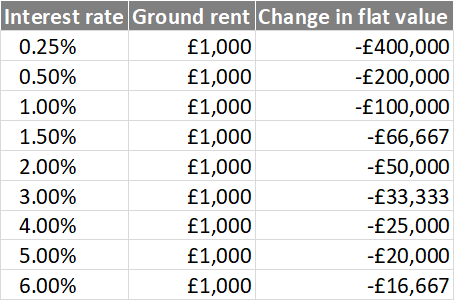

Figure 3: Interest rates and different flat values

The table shows how as interest rates rise, the amount of money you need to cover a fixed ground rent and service charge decreases. If you receive 0.5% interest rate from your bank, you will need £200,000 saved to provide enough interest to cover £1,000 of costs per year. However, at a 4% interest rate, your only need £25,000.

This means that at interest rates of 4%, you would need to knock off £25,000 from your flat, for every additional £1,000 of costs your flat has in the long-term – assuming that these extra costs do not increase the living standards or value in the property (e.g., by paying for 24 hour porterage).

The opposite however is true with inflation. If the costs increase for the same level of service, then this will lead to a total decrease in your flat value.

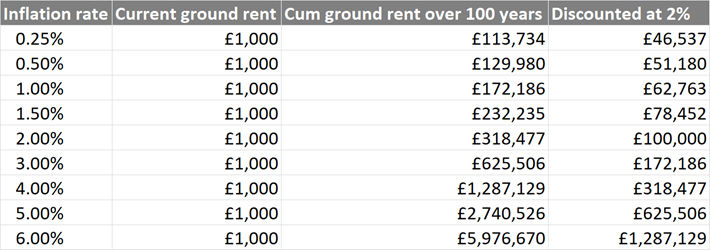

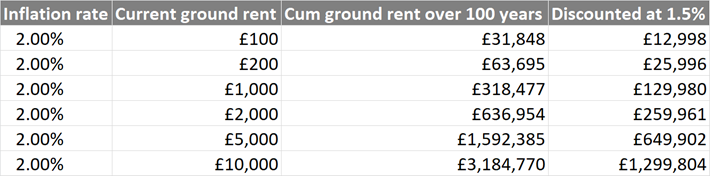

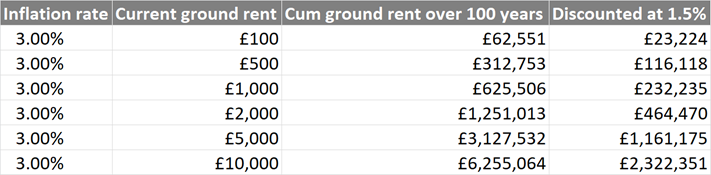

Figure 4: the amount of money needed to cover inflating costs

Therefore the higher the expected rate of service charge or ground rent inflation, the more money you need to take off your flat’s price today. Or putting it another way, the more you need to put in a bank today, to be paid enough interest to cover all future charges.

Using forecasts to model your current flat value

The Office of Budget Responsibility has estimated the long-term houses prices, interest rates and inflation, which can be used to calculate your flat’s current value.

Figure 5a: OBR house prices growth forecasts until 2022

Figure 5b: OBR inflation forecasts until 2022

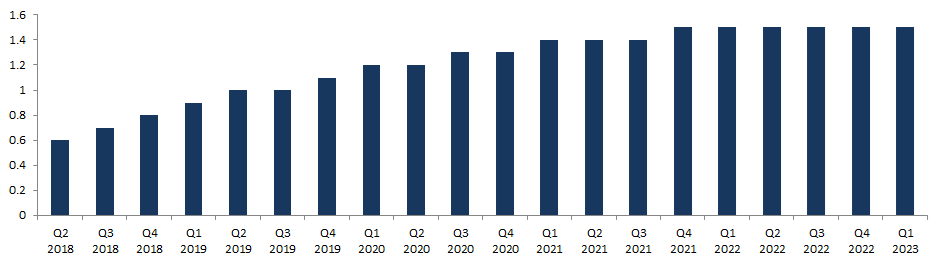

Figure 5c: OBR interest rate forecasts until 2023

By calculating the long-term average interest rates and inflation, we can show the additional discount that should be paid for every additional £100 in ground rent or service charge inflation.

Figure 6a: table of discount based on OBR forecasts – using CPI estimates

Figure 6b: table of discount based on OBR forecasts – using RPI estimates

Based on your expectations of future service charge inflation being closer to either an RPI or CPI forecast, you will produce different valuation of your flat’s current price.

Decisions you should make to improve your flat and building values

How you manage your building

As can be seen, a saving of £100 per year in unnecessary payments can increase the value of a flat in your building by as much as £20,000. This can be seen as the value that is currently going to your freeholder (in terms of ground rent) or suppliers (in terms of service charge).

Therefore if you are able to reduce long-term costs even by a small amount you can make big value increase – e.g., by:

- Getting rid of your ground rent or reducing it

- Looking at ways to reduce waste with the service charge

- Fixing your service charge costs to reduce the risks of inflation

- Spending money on capital projects to reduce the yearly payments e.g., replace old, inefficient boilers and expensive lifts

Your sales price

Interest rates have been at historically low rates for the past 10 years which in effect has meant that small increases in service charges have had a much bigger impact on reducing flat prices. As interest rates begin to increase again, this should level off – helping to automatically increase flat prices against properties with £0 ground rent.

However, it should be appreciated that reducing the waste in your service charge and getting rid of your ground rent (if possible), will have big effects on your flat values – much larger than the value of any single year payment.